Buying a car – it’s a big step, and can represent a massive financial commitment. But you shouldn’t be daunted by the magnitude of the decision you’re making. You can get help with every step – from your early research to find the right car, and especially advice to make sure you spend your money wisely.

What’s more, you can take advantage of lots of choice, as specialists in car finance compete for a share of this valuable business. To do this, they have evolved new products, with a host of useful features, but also with conditions that you need to be aware of.

In this article, we delve deep into these products, outline the main benefits of each, and suggest the best situations in which to use them.

The process of buying a car

The internet is where most people start. It’s become such a popular place to search, simply because it saves hours of trudging around lots of different dealerships and franchises, especially if you’re looking for a specific car.

For a classic car such as an Aston Martin or a supercar, online forums for owners’ groups, many of which also let users advertise cars for sale, have become the go-to place, and are full of helpful, real-world advice. And of course, social media platforms also make it easy for owners to share their experiences of living with cars day-to-day.

Classic car magazines, such as Classic Cars, Autocar and Classic and Sports Car, also carry lots of ‘for sale’ ads. Sellers know that readers are already keen on a specific type of car, so might either be actively looking to buy, or sizing up their options for a future purchase.

The days of when the only contact details sellers would give was a telephone number are long gone. Now, many give an email contact address, and WhatsApp contact, meaning you can talk to them directly, and take the route to buying at your own pace.

Eventually, you should always take a test drive – a keen seller knows this is vital to clinch a sale, and can use it to showcase a car’s best features and potential. And asking lots of questions will show that you’re serious.

Before you buy a car, it’s important not to let your heart rule your head. Think hard about how to pay for it, because there can be vast differences between even deals which, on the face of it, are broadly similar.

However, this guide will help you to confidently distinguish between the various types of finance available. The aim is to have the complex world of car finance explained in simple terms, to help you choose the way of buying a car that works best for you and your circumstances.

See below what you should take in consideration when buying a prestige marque:

Frequently asked questions about car finance

WHAT IS CAR FINANCE AND WHY USE IT?

Car finance or auto finance, refers to a range of ways of borrowing money to buy a vehicle, and paying at least a proportion of it back, usually with interest, over an agreed period, usually expressed as a number of months.

This means that you can drive the car you want without having to shell out all the cost up-front, and having lots of money tied up in an expensive car.

HOW DOES CAR FINANCE WORK?

With every car finance agreement, you commit to pay the total amount of the loan, plus any interest, over a set number of months, usually making your loan repayment by direct debit or standing order monthly, until the loan is repaid.

A finance agreement usually involves the buyer paying a set amount as a deposit. The remaining cost of the car is then the subject of a monthly payment plan. Such plans are designed to either pay off the whole balance outstanding, or a proportion of it – usually the amount which the car will be expected to lose in value over the course of your agreement.

There is a car finance product for every purpose – you might just need help to find the best one for you, which is what we are going to explain further below.

ADVANTAGES AND DISADVANTAGES OF USING CAR FINANCE

If you always run your finances according to the saying “neither a borrower nor a lender be”, and prefer to earn the money you need to buy something first, and pay in cash, you’ll benefit in lots of ways.

You’ll avoid paying interest, so as soon as you’ve paid your money, you own whatever you’re buying with nothing more to pay.

The trend for most buyers to finance cars using some form of loan is fairly new, but the market has developed quickly. Now, there are lots of car finance options and every situation is catered for.

Here are few things to consider before deciding for a car finance:

- Credit eligibility and your credit record – make sure you understand your credit history and you qualify to apply for a loan.

- How much you can comfortably afford in monthly payments

- The amount you can put down as a deposit – either as cash, by trading in an old car, or possibly both

- The length of time you want to keep the car

- Whether you want to be limited to a maximum mileage over the time you’ll be paying for the car, and

- What you want to do with it at the end of the term of your car finance agreement

- Consider the current value of your car and depreciation over the period of your loan

- Additional expenses, such as car insurance, car running costs, loan processing fees, early repayment penalties.

HOW DO I COMPARE CAR FINANCE AGREEMENTS?

The first step is to understand your circumstances, and how they affect the way in which a car finance company will use them to assess your application for any finance product.

A specialist such as JBR Capital can evaluate the car you’re considering, and its affordability, based on the information about yourself which you give them.

It will then recommend one or more products which match your needs, and the purpose you will be putting the money to.

You will always get a fuller picture of your options, their likely costs, and how they match your needs and circumstances if you are buying a specialist car from people with a track record in this area, because they have the contacts and knowledge to give you the full picture – and not just sell the benefits which are on offer.

HOW DO I COMPARE PCP AND HP AGREEMENTS?

Always consider the amount of deposit being quoted, especially if it is a large proportion of the asking price, which may help get you a cheaper deal.

A PCP could be right for you if:

- You want to make the lowest possible monthly payments

- You don’t know what you want to do with the car at the end of your agreement, or would like time to consider your options, and

- You’re buying a new car taking advantage of a sizeable deposit contribution from the manufacturer, and the interest rate is lower than for borrowing the same amount on hire purchase.

Or consider HP finance if:

- You want to keep the car at the end of the agreement

- You don’t know what mileage you are likely to cover, or don’t want it to be restricted

- You can comfortably meet the payments, and

- Having compared PCP and HP, the total cost (amount borrowed plus interest) is less than for the same amount under a PCP finance scheme.

It might involve some prep work, but you can make an informed choice about how to finance a supercar, and get a quick answer online to any questions – even if these aren’t already covered in the site’s car finance FAQ section.

HOW TO GET THE BEST FINANCE DEAL FROM A DEALER?

Buying a car from a dealer means it will have been put through stringent pre-sale checks to uphold their reputation.

But high showroom overheads mean there’s less room to negotiate discounts, especially as one of the main ways in which they make their profit is through arranging finance cars.

However, if you have a large deposit, especially in cash, you’re better placed, as you’ll be considered a much lower risk than someone shopping for pay monthly cars with a small or no deposit. So you may get the very best, lowest-rate finance car deals.

WHAT ARE THE MAIN CAR FINANCE OPTIONS, AND THEIR PLUS AND MINUS POINTS?

Here, briefly, are the main ways to finance a car, along with details of the most important ‘pros’ and ‘cons’ of each.

Dealer finance: Most dealers offer an array of finance car deals, packages and options. Looking at all those figures in isolation can make your head spin – but the car itself isn’t necessarily the most profitable part of a sale for many dealers. Many make more money in commission through selling various car finance packages than in profit on the cars themselves – just because the market is so crammed and competitive.

So that they can compete in this cut-throat market, dealers usually exclusive rights for a finance company to offer its products through their outlets.

A franchised dealer may not have any choice in which company that is, so it offers a range of ‘off the shelf’ products on the finance company’s behalf.

Credit card: This could be a ‘last resort’, expensive option to someone who’s already got a good credit record, so could get a better deal on buying a car from lots of other sources.

But if you have a card with a high credit limit, and can pay the debt back at 0% interest over the longest possible period, it could be a cost-effective way to even finance a prestige car, which also offers important benefits for your peace of mind.

Importantly, make sure your monthly payments clear the amount paid on your credit card before the end of any 0% or reduced interest period – or you’ll suddenly find your payments will shoot up.

Self-Finance: Paying upfront for the car of your dreams is incontestably the best way to purchase a vehicle, however if you are planning to purchase a classic car or high-performance vehicle or finance a car restauration project, choosing car finance might be a better idea, since you won’t block a lot of cash into your purchase.

WHAT CRITERIA DO YOU NEED TO MEET TO APPLY FOR CAR FINANCE?

Companies providing funds for buying a car in the UK are tightly regulated, and must subject you to an affordability check, to broadly indicate whether you can meet the financial commitment.

They will find out your credit score from a specialist agency, which indicates whether you’re likely to present an acceptable risk for the lender.

In order to apply for a car loan, you will have to provide the below information:

- Gross annual income

- Are you a house owner or now?

- How long you lived at the current address?

- Ownership of any businesses and assets like properties, other cars.

- Level of existing financial commitments, such as monthly rent/mortgage repayments

- Other outstanding loans or credit card debts

If you have questions about car finance, we’ve most probably covered them

1. HIRE PURCHASE (HP)

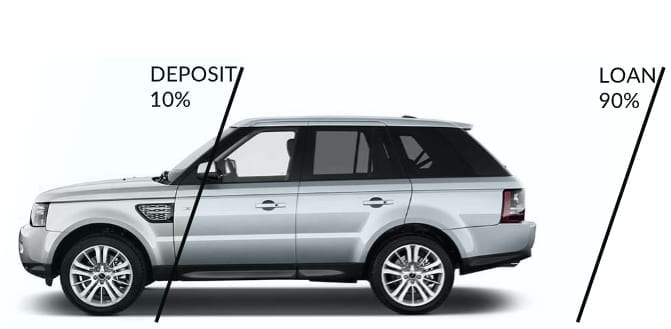

The amount of your hire purchase agreement is the difference between your deposit, and the total purchase price.

Say you buy a car for £35,000, and pay a £7,000 deposit. So your outstanding hire purchase agreement is for £28,000. You will be asked over how many monthly instalments you want to spread your payments, and using a car finance calculator, can work out your monthly payments.

At the end of your loan period, provided you’ve made all your payments, the car is yours, with nothing more to pay – except for a one-off documentation or administration fee.

2. LEASE PURCHASE (LP)

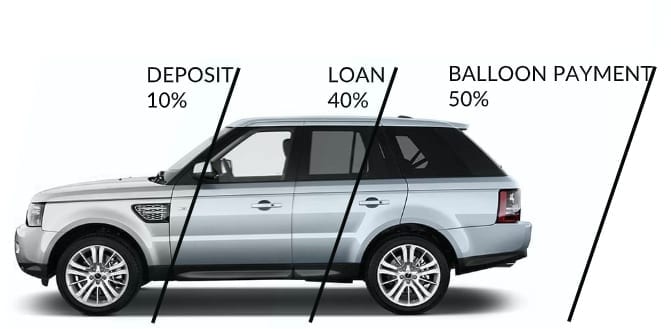

Sometimes referred to as hire purchase with balloon payment, lease purchase is a great way of financing a car because it gives you a lower monthly repayment than under standard hire purchase.

It is very similar to a Personal Contract Plan, or PCP (see below). But you can’t return the car at the end of your agreement. Instead, you can sell the car, using the proceeds to fund the balloon payment amount, part-exchange it for another car, or keep the car and refinance the balloon payment.

Like a PCP, financing a car on lease purchase involves deferring paying a portion of its total cost until the end of your finance agreement. But you don’t own the car outright at any point, unless you cancel your agreement and pay the outstanding balance in full.

The deferred amount is called a ‘balloon payment’ because it gives you a ‘soft landing’ at the end of your agreement term, and you can choose to either pay the amount due in cash, or by taking out a further loan.

The annual mileage you can cover may be limited, but not as tightly as under a PCP.

3. PERSONAL LOAN (PL)

The longest-established way to finance cars, it is the original plan designed for people choosing to pay monthly cars’ cost. You can easily find out how much your monthly payments will be, as there are lots of personal loan illustrations available.

These will quote a ‘typical APR’, or Annual Percentage Rate of interest, offered to most people who are accepted. If you have a particularly good credit record, you might be offered a lower rate. A personal loan covers all the outstanding amount after your deposit, so you own the car outright after the last payment under your loan agreement.

4. PERSONAL CONTRACT PURCHASE (PCP)

Essentially a type of hire purchase, this is now the most popular type of car finance, accounting for nearly eight out of 10 new cars bought. It is a type of hire purchase, but you can hand the car back at the end of your agreement period, sell it, or part-exchange it for another car. The mileage you cover is likely to be restricted, and penalties will apply if you exceed this total.

Under a PCP, you put down an initial deposit – a higher deposit will reduce your monthly payments. The deposit, plus your monthly payments, pay off the amount the car loses in its value (called depreciation) over the term of your PCP agreement. You again defer payment of a chunk of the car’s price until the end of your agreement, then have the options outlined above.

4. PERSONAL CONTRACT HIRE (PCH)

This is also known as Leasing and works like a long-term car hire agreement, available to individuals rather than businesses. You agree to drive the car for a certain period, making fixed, monthly rental payments for a set contract length.

However, unlike having a car on lease purchase, you must hand it back at the end of the contract.

5. CAR EQUITY RELEASE

If you own a highly sought-after car, you could be lucky enough that its value increases, just because it’s so desirable. You can then use the difference between what you paid and its current value, known as equity, to release funds to finance buying a car, perhaps for day-to-day use. So, for example, if your car is a prestige model, its value may have grown enough during your ownership to let release some of its value for an auction purchase. Or you could even use the money released to finance a race car.

But you can also put the money raised to other uses, such as starting a new business or investing in buying a property. With equity release, you sell your car to a specialist in classic car finance, who sells it back to you under a hire purchase agreement.

You have to make the regular payments required, but can use the value of your classic car towards buying a further car, perhaps for everyday use while keeping your McLaren finance running, so making good use of its desirability. For equity release on a classic car the car acts as security, and must be worth at least £100,000.

BEST FINANCE OPTIONS BY THE TYPE OF CAR

NEW CAR

Most new cars – more than eight out of 10 according to automotive sector newsletter AM Online – are sold using Personal Contract Plans.

These are popular because of the low deposits and relatively low monthly payments, because you aren’t actually buying the car outright, and are just funding the cost of its depreciation – what it loses in value while you run it.

As a result, they have brought driving a new car within lots of people’s reach.

But the availability of car hire purchase agreements with terms as long as 48 months also makes this a viable option. You can either trade the car in and use the proceeds as a deposit for your next car, or continue to run the car.

USED CAR

Hire purchase is always a popular option here.

Because you are buying a car which has already lost much of its value, you can often get a lot of car for your money. And there may still be some original warranty remaining from your car’s manufacturer.

Also, working out your hire purchase repayments is straightforward once you know how much you need to borrow, and the length of your repayment term.

Then, you have the comfort of knowing that you own the car outright once you’ve made all your payments.

Lease purchase is also worth considering, because it will lower your monthly payments as you will defer a portion of the cost to be met as a balloon payment.

CLASSIC CAR

Your best option depends on whether you want to own the car outright, enjoy it for a couple of years before changing it for another one, or make the lowest possibly monthly payments.

HP will be best if you want to keep the car long-term, as you’ll eventually be free from paying anything.

Lease Purchase could be suitable because of the wide range of schemes available, and your classic car should keep enough of its value to comfortably meet the balloon payment at the end of the agreement. Also, if you are only using the car occasionally, you shouldn’t have to worry about any mileage restrictions attached.

If you already own a classic car, then equity release could mean that you don’t have to find extra cash for a deposit to expand your collection.

SUPERCARS/HIGH PERFORMANCE CARS

If you were to try to ask your bank manager for a loan to buy a supercar, he may well not have much time for you. So using a specialist in helping discerning customers’ access the funds needed, will pay off.

A prestige car demands custom finance, so that you can afford the car of your dreams without the commitment involved becoming a nightmare.

If you’re after the exclusivity and cachet of driving the best cars, then contacting a true specialist who knows how to finance a supercar in the most cost-effective and flexible ways is wise.

RACING CARS

Getting involved in car racing lets you experience the true thrill of exploring the upper limits of a car’s performance and capabilities.

But buying a car to race is seen by most lenders as a high risk, and many purchases are made in cash. But there is always strong demand for a proven racing car, so if you have the facilities to look after one properly, you may be a suitable candidate for equity release finance.

See our earlier explanation of how this works, and get in touch if you’d like to find out more.

BUYING A CAR AT AUCTION

Auctions have always been a suitable place for buying prestige cars, because many attract a knowledgeable clientele who appreciate the rarity and unique qualities of such vehicles.

Equity release is a suitable option for an auction purchase. If you already own a prestige car, you can realise some of its value to become a cash buyer – and with your finance already in place, you also know how much you can afford to bid.

CAR RESTORATION PROJECT

Such a project will involve a big commitment, both in terms of your time, and financially.

So you should call on a specialist company which has excellent contacts with finance providers sympathetic to these particular circumstances.

Car finance options for this kind of purchase include phased release of a loan amount, so you only pay interest on the amount borrowed. But because this is also a small, niche product, you should take your time, and research the options you have, making use of any car finance FAQ to make sure that you know what is on offer, and the commitment it involves .

In conclusion, ‘how does car finance work’ is a question with many possible answers. For a bespoke solution, talk to JBR Capital, experts in finding custom packages for buying a car for the most demanding and discerning customers.

BROWSE ALL RESOURCES

IN-DEPTH GUIDES

CAR FINANCE EXPLAINED

BUYING GUIDES