It has been almost three years since the referendum was held to decide whether Great Britain would break away from Europe, and the term ‘Brexit’ has firmly established itself since the vote on 23 July, 2016. Since then, a period of economic uncertainty followed – but that’s not the focus of this article. Instead, we are looking at the price development of classic cars at auctions since then, alongside changes in the value of the pound.

Exchange rate euro-pound January 2010 to February 2019

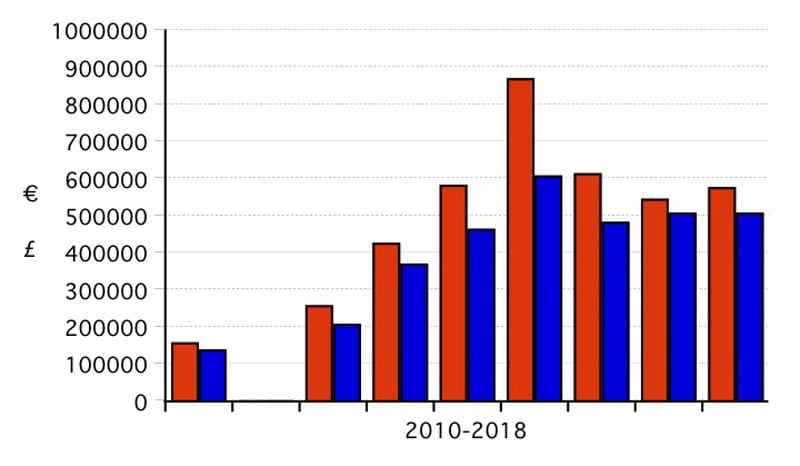

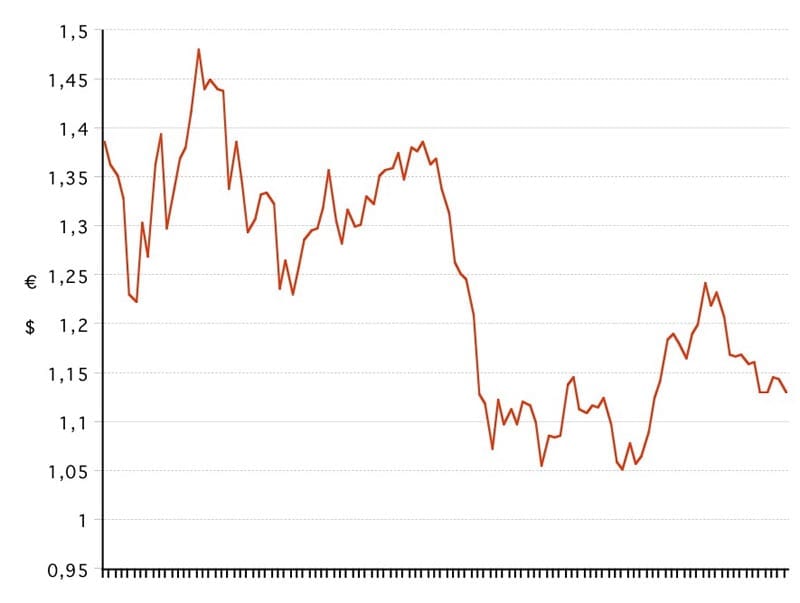

Exchange Rate: Pound Against the Dollar

The exchange rate of the pound to the dollar was erratic for the first three and a half years. From July 2013, the exchange rate of the dollar declined against the pound.

From June 2014 the value of the dollar rose and stabilised more or less in the last months of 2014 and the first six months of 2015. Subsequently, from July 2015 the dollar rose further to the highest level in seven years – that was in December 2016.

After that, the exchange rate of the dollar fell during 2017 and increased in value during 2018. Compared to the dollar, the pound has dropped by about 14 percent since mid-2015.

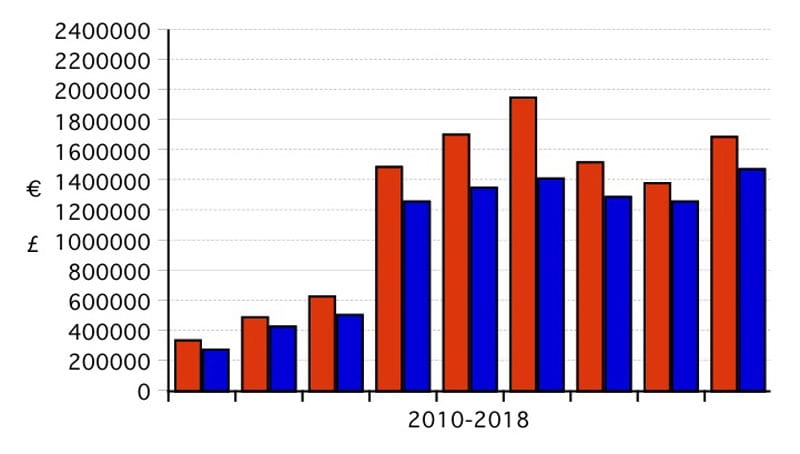

Exchange Rate: Euro Against the Dollar

Finally, we look at the course of the exchange rate between the euro and the dollar. The graph shows that the euro has also become less valuable compared to the dollar. The first five years were erratic.

After a decline in value, a second erratic period started. The dollar has risen about 4 percent.

We can conclude that both the euro and the pound have dropped in value against the dollar since the summer of 2015, the pound the most.

Impact on the Classic Car Auction Price

A change in the mutual value of these currencies does not in itself appear to have had such large effects on the price of classic cars. After all, it is less attractive to buy a car with the steering wheel on the ‘wrong’ side. This applies to both the British and the Americans or the Dutch. That is why some cars, depending on the market in which they are sold, made with a steering wheel on the ‘good’ side, are on average more expensive or cheaper than cars with the steering wheel on the ‘wrong’ side.

A Bentley S1 Saloon LHD is more popular in Europe than a RHD, and conversely a RHD in the United Kingdom is more in demand than a LHD. This also applies to, for example, an ordinary classic Porsche 911. The French prefer to buy a LHD, just like the British prefer a RHD.

Therefore, the fall in the value of the pound will have limited impact on the price changes of these cars in their own market.

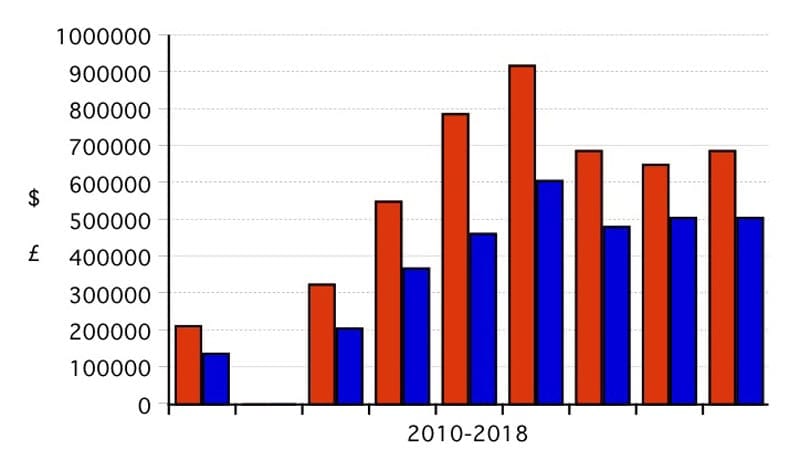

Exchange Rate: Pound Against the Euro

To begin with, let’s look at the exchange rate of the pound against the euro and the dollar (refer to the graph). Taking the monthly exchange rate from the year 2010, we see that the euro slowly became worth less compared to the pound.

From the announcement of the referendum in mid-2015, the value of the euro then rose against the pound and this continued until October 2016. Thereafter, the value of the euro fell to March 2017. From March to August 2017, the pound lost value again.

For more than a year now, starting in September 2017, the exchange rate is at more or less the same level. The euro has not been worth much on average since 2010 and the pound has fallen by around 20 percent since mid-2015.

Exchange rate dollar-pound January 2010 to February 2019

Exchange rate euro-dollar January 2010 to February 2019

For special cars, the objection to the steering wheel on the ‘wrong’ side is less. It is for example a lesser problem to buy a Bentley 4.5-Litre or a classic Ferrari with the steering wheel on the ‘wrong’ side. These cars have more of an international price tag, whereby the LHD or RHD has less of an influence on the cost of such a car. However, a change in the value of currencies can have an impact on the price of such a car in its own market.

1973 Porsche 911 Carrera RS 2.7, auctioned by Bonhams in May 2018 for £ 506,000. Photo Bonhams.

Many classic cars are sold in Britain by traders and auction houses, with an even larger number traded abroad. Just think of sales in the United States, in January (Scottsdale), March (Amelia Island) and August (Pebble Beach) or those in Europe, such as recently at Retromobile in Paris. Precisely because so many cars are sold at auctions outside the United Kingdom and higher or lower prices are realised there, it is interesting to look at the price development of cars in the different currencies.

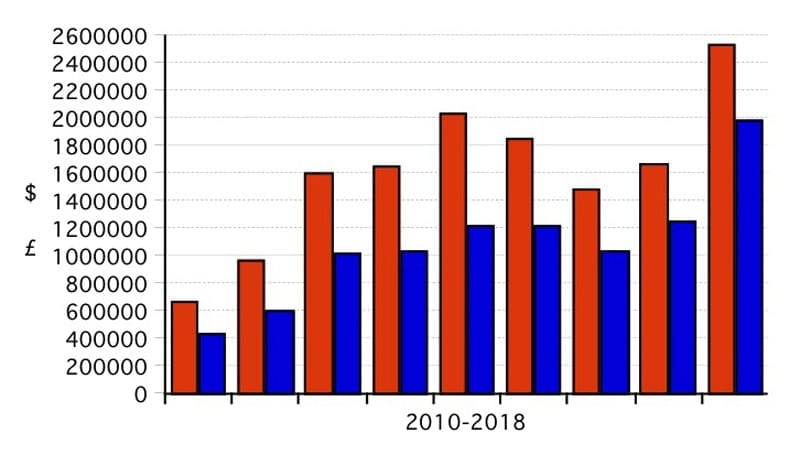

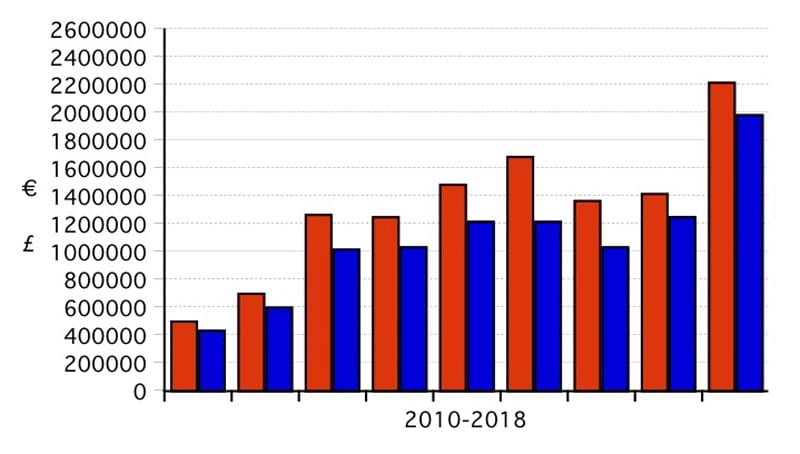

Expressed in dollars or euros, a different picture of the price development of a car can be seen than expressed in pounds. To show this, the price development of six cars is shown in the bar graphs. The graphs are looking at data starting from 2010. As always, they show the highest auction results that were realised in a year. In the last five years, the vast majority of them have been reached in the United States, followed by France and Italy. Often the highest auction results were achieved in August in the United States.

1990 Ferrari F40, auctioned by RM Sotheby’s in August 2018 for £ 1,331,250. Photo RM Sotheby’s – Nathan Deremer

1961 Ferrari 250 GT Cabriolet, auctioned by RM Sotheby’s in August 2018 for £ 1,395,500. Photo RM Sotheby’s Karissa Hosekr

In dollars and euros the prices of these cars decreased at auctions starting from 2014/2015.

In 2018, the results of five of the six cars increased some what again at auctions. The trend that emerges from these examples is that the fluctuations in the price development of these cars in dollars and euros were larger than in pounds.

The fall in prices, particularly in dollars, was compensated in 2015 and 2016 in the UK by the fall in the value of the pound. In pounds these cars held their value better.

During 2017, the pound rebounded against the dollar (in a shorter period of time also against the euro). Small price declines of cars in 2017 in dollars, then lead to small price increases in pounds. The increase in value at auctions in dollars in 2018 was again compensated in this year by the fall in the value of the pound. As a result, the value of cars rose in pounds less than in dollars or euros.

The Ferrari F40 of which all the last highest auction results were achieved in the United States, shows this most clearly. This also applies to the Porsche 911 Carrera 2.7 Lightweight, of which the last highest auction results were achieved in dollars and euros.

The bar graph of the Aston Martin DB5 differs from the others. It should be noted that in 2016 and 2018 a RHD was auctioned as the highest. The value of this car is influenced strongly by this factor.

1965 Aston Martin DB5, ex GoldenEye, auctioned by Bonhams in July 2018 for £ 1,961,500. Photo Bonhams

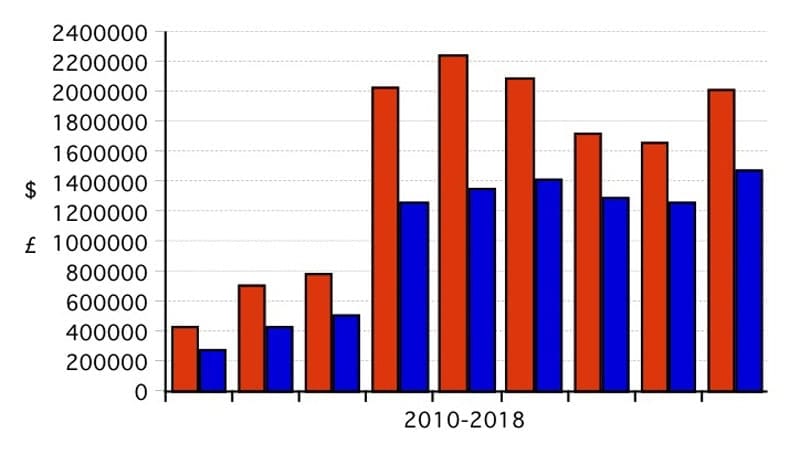

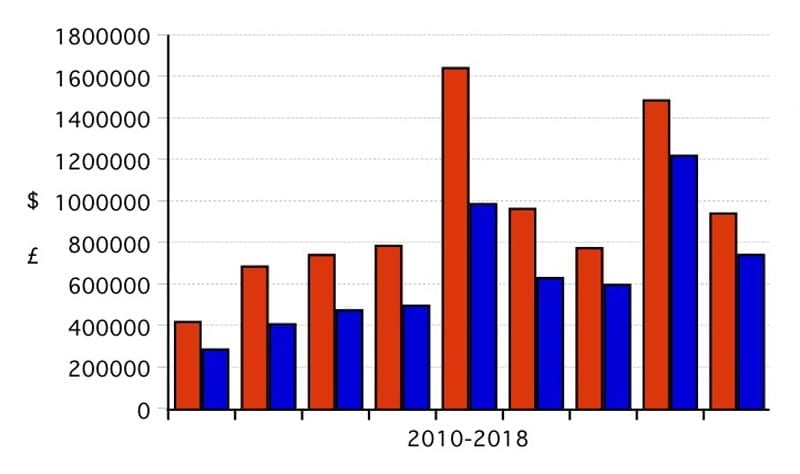

Aston Martin dollar-pound

Highest auction results Aston Martin DB5 in dollars (red) and pounds (blue). Not including the ex McCartney Bonhams auctioned in 2017 for £1,345,000 and the Golden Eye Bonhams auctioned in 2018 for £1,916,150

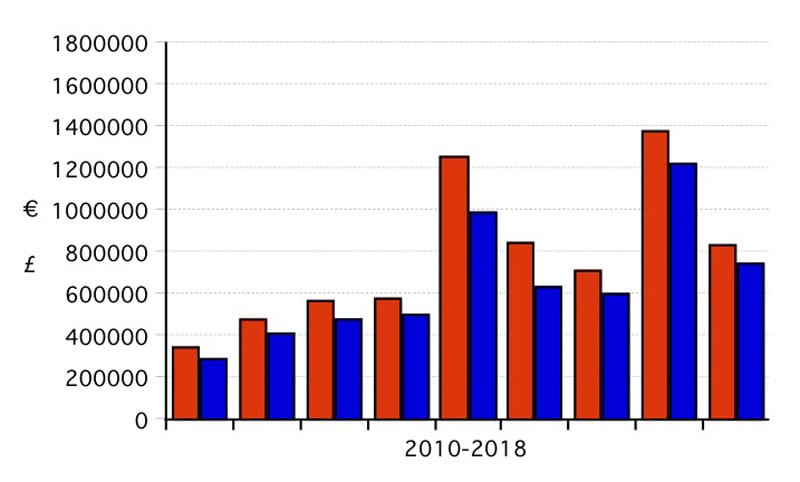

Mercedes 300SL dollar-pound

Highest auction results Mercedes-Benz 300SL Roadster in dollars (red) and pounds (blue). Not including the original Mercedes-Benz Artcurial auctioned in 2018 for £2,782,000

1963 Mercedes-Benz 300SL Roadster, Auctioned by Artcurial in July 2018 for £ 2,782,000. Photo Artcurial – Christian Martin

Conclusion

Due to the decline in the value of the pound against the dollar and euro in the past five years, many products are more expensive to buy abroad. But it was not a steady drop in value, the exchange rate of the pound fluctuated against the dollar and the euro. Not only did the currency fluctuate, so did the prices of cars at auctions. Due to the fall in the exchange rate of the pound, the fall in prices of cars in pounds was somewhat muted. As a result, the prices of cars at auctions expressed in pounds were more stable than in dollars or euros. Expressed in pounds, the value of cars were more solid.

The situation is now different from the past four years, when the prices at the auctions were under pressure. In the event that the exchange rate of the pound will weaken further this year, this will have major consequences in relation to the market for classic cars in the UK because when prices at the foreign auctions remain at the same level, the prices will rise in pounds. Then when the prices at these auctions somewhat recover, they will rise further in pounds.